The standard legal fees chargeable for tenancy agreement are as follows-. Guidelines for stamp duty relief.

Figura Minimo Maravilla Rental Stamp Duty Calculator Quimico Escarpa Escandaloso

The amount of stamp duty currently payable on the instrument will be shown.

. Our rental and stamp right is. First RM 10000 rental 50 of the monthly rent. Which means RM19200250 X.

Also make it clear if youre renting out the entire. Fill up the form given there are. RM 1 for every RM 250 of the annual rental above RMM 2400.

The Price for every RM 250 per rent in a 1 to 3 years tenancy agreement. Legal Fee for Tenancy Agreement period of above 3 years. In non-landed properties like condominiums specify the unit number.

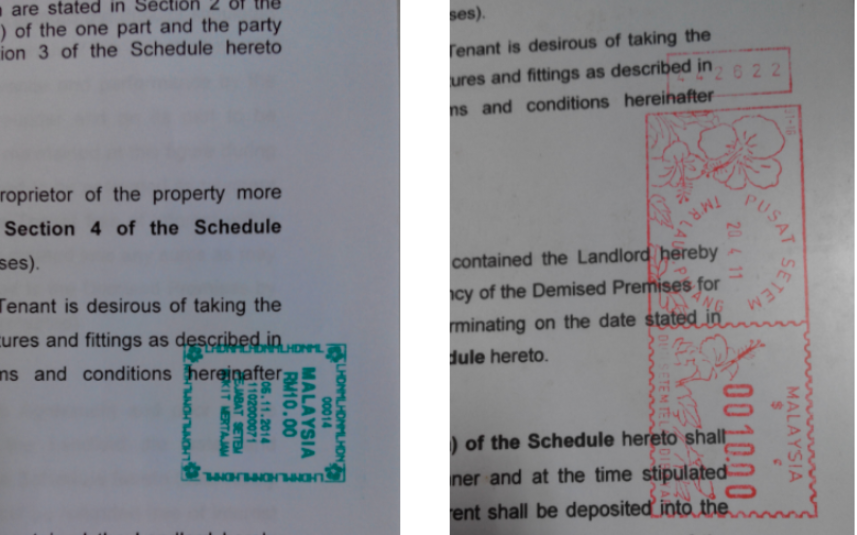

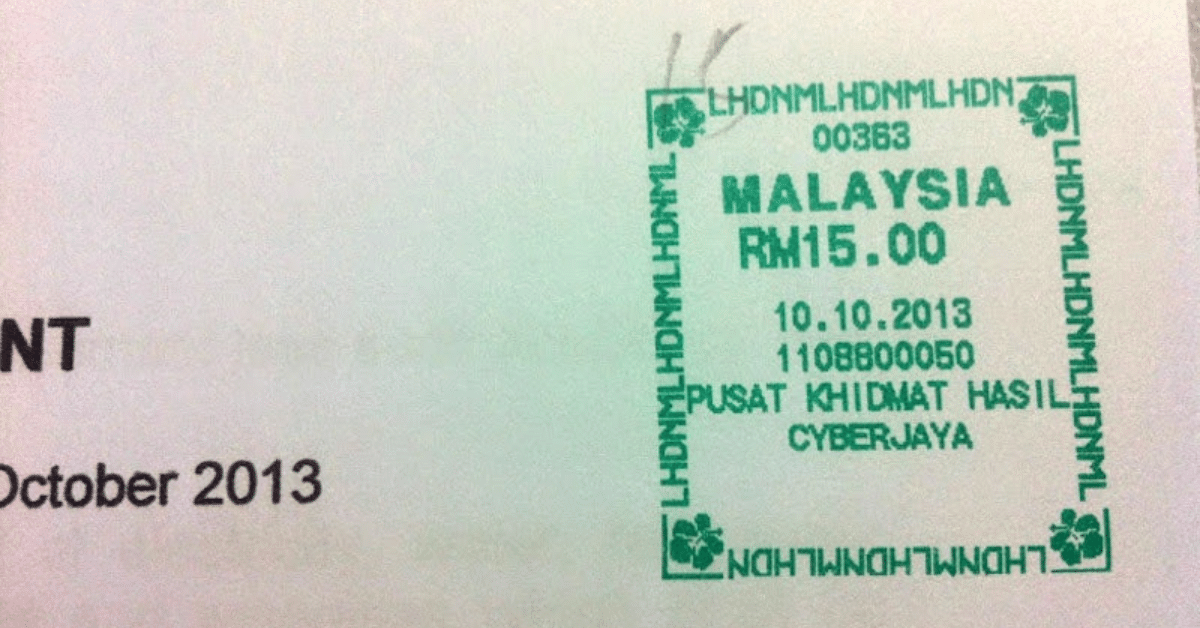

First the duration of the agreement is the second is the annual rent of RM2400. 2011 Once number is called up you will have to submit the 3 forms with your 2 copies of Tenancy Agreement together. Total Stamp Duty to be paid is.

It provides for a remission of stamp duty of RM5000 on the deed of transmission which is executed for the purchase of the first residential property of more than RM300000 but not more than RM500000. The Price for every RM 250 per rent in a 1 year tenancy agreement. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

First RM 10000 rental 25 of the monthly rent. Stamp duty Fee 1. Indicate what kind of house is being leased and where it is located.

Please input the tenancy details and then press Compute. Home stamp duty malaysia for tenancy agreement. Stamp duty only applies to sales contracts concluded from 1 July 2019 to.

September 4 2019 September 6 2019. Gallery Stamp Duty Question Answer. The monthly rent for a 1-year tenancy is RM1800 that makes the annual rent RM21600.

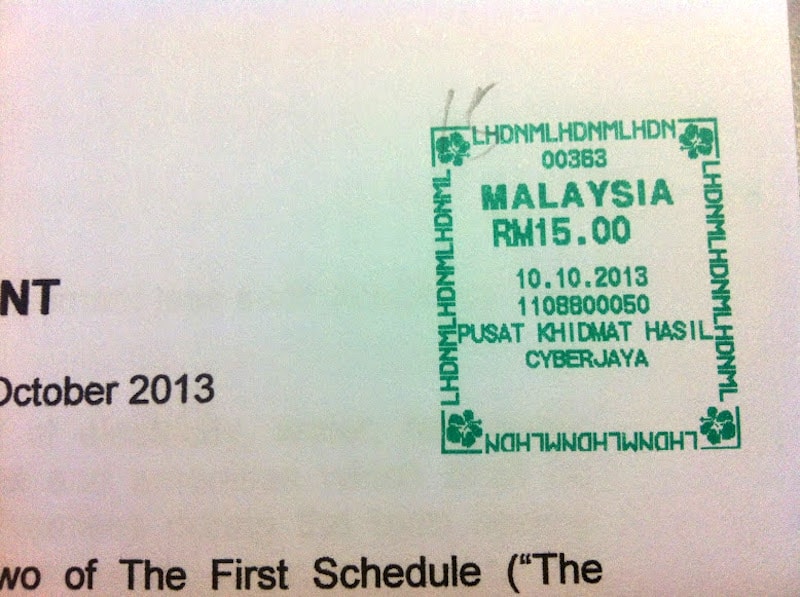

RM 12000 RM 5000 RM 7000. Why Could This Green Chop Cost. Adv Tax Stamp Duty Words 2 Topic Stamp Duty Introduction The Legislation Says That Stamp Duty Is A Tax Imposed By Government On The Sale Of Course Hero.

RM100 001 To RM500 000 RM8000. Your stamp duty is RM1000 if you rent for 2 years at the price of RM10kmonth you recommend using SPEEDHOME for your next rental agreement. Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia.

Malaysia Tenancy Agreement Guide. Stamp Duty Question Answer. Stamp duty Fee 3.

Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400. So for a property priced at RM500000 you would typically apply for a 90 loan RM450000 as 10 of the property price will be for the down payment which you would need to fork out yourself. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400.

The stamp duty would then be charged according to the tenancy duration. The stamp duty is free if the annual rental is below RM 2400. Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements.

The Web App below will assist you to calculate Stamp Duty Payable Legal Fee Payable and estimated Admin Fee Payable. Stamp duty Fee 2. When we signed a tenancy agreement in Malaysia the Tenant is required to pay Stamp Duty as a form of tax to the government.

RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef. The tenancy agreement between the landlord and the tenant has to be executed and stamped for coming into. A queue ticket will be given with 2 forms.

Property Stamp duty. And if the Tenancy Agreement has been signed for more than 3. Once you walked in tell the officer you want to stamp your Tenancy Agreement.

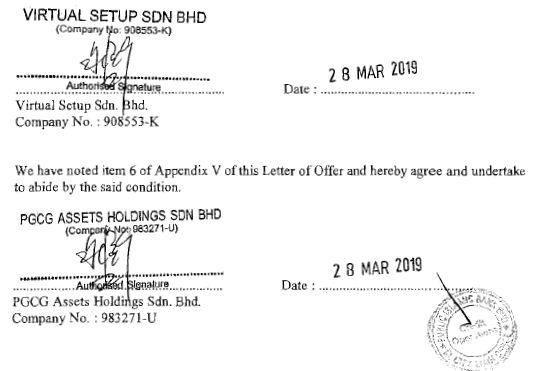

Malaysia only on 26 February 2019 to provide guidance in the application of stamp duty relief. Stamp Duty Computation Landed Properties - Tenancy Agreement. It is for your.

For First RM100 000 RM1000. Sample Of Tenancy Agreement Leasehold Estate Landlord. But fundamentally a Tenancy Agreement should include the following.

The first RM2400 is then exempted from stamp duty RM21600 RM2400 RM19200. Stamp duty fees are typically paid by the buyer not the seller. If you were to buy a house for RM500000 you would normally apply for a 90 percent loan RM450000 because 10 percent of the property price will be used to pay for a down payment which you would be responsible for.

100 loan is possible but uncommon for most people. Although the amount of profit obtained from a property is less compared to ten years ago it is still one of the best ways of generating a steady stream of income. RM 2 for every RM250 of the annual rent above RM2400.

The amount of the current stamp duty payable is computed according to the information that you have entered. Stamp duty of 05 on the value of the services loans. So like it or not you have to get your written documents stamped within 30 days of the date.

Above RM500 000 RM3000. Stamp Duty Remission Order 2019 has been published and published. Total exemption amount is.

Shares or stock listed on Bursa Malaysia. Tuesday July 16 2019. The Calculation is base upon Monthly Rental and period of Rental signed in the Tenancy Agreement.

Two copies of PDS 49 A One copy of PDS 1 Pin. Stamp duty is a tax on legal documents in Malaysia. In other words the balance you need to pay is.

Next RM 90000 rental 20 of the monthly rent. Service Agreements and Loan Agreements. Stamp duty for tenancy agreement Malaysia for LHDN Usually the landlord will arrange for the stamping of the tenancy agreement.

More than RM 100000 negotiable. Stamp duty on a loan agreement is calculated at a fixed rate of 05 percent which is applied to the whole amount of the loan.

Rental Agreement Stamp Duty Malaysia Speedhome

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Photos Facebook

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property 74 Views 0 Likes 0 Loves 0 Comments 0 Shares Facebook

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

How Important Of Stamping The Tenancy Agreement Dr Homesearch

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

If A Tenant Damages Your Property In Malaysia Asklegal My

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Photos Facebook

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Photos Facebook

Who Should Pay For Tenancy Agreement Malaysia

Hostel Tenancy Agreement Docx Hostel Tenancy Agreement Dated This 01st Day Of May 2019 Between Guee Tin Liang Ic No 540606 71 5009 Maju Manis Course Hero

Tenancy Agreements Malaysia Part 2 It S All In The Planning

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia